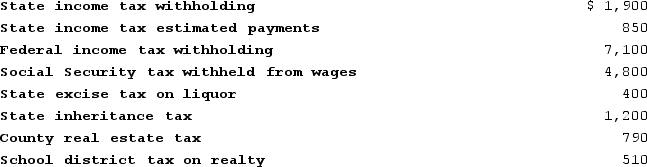

Chuck has AGI of $70,000 and has made the following payments:

Calculate the amount of taxes that Chuck can include with his itemized deductions.

Calculate the amount of taxes that Chuck can include with his itemized deductions.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q89: This year, Benjamin Hassell paid $20,000 of

Q90: Kaylee is a self-employed investment counselor who

Q91: This year, Benjamin Hassell paid $17,250 of

Q92: Detmer is a successful doctor who earned

Q93: Last year Henry borrowed $15,000 to help

Q95: Alexandra operates a garage as a sole

Q96: Kaylee is a self-employed investment counselor who

Q97: This year Tiffanie files as a single

Q98: Last year Henry borrowed $22,000 to help

Q99: Campbell, a single taxpayer, has $400,000 of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents