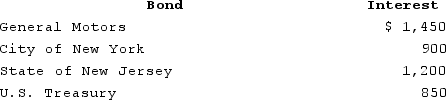

Mike received the following interest payments this year. What amount must Mike include in his gross income (for federal tax purposes) ?

A) $1,450

B) $2,300

C) $2,650

D) $3,550

E) $4,400

Correct Answer:

Verified

Q76: George purchased a life annuity for $3,200

Q77: Nate is a partner in a partnership

Q78: This year Mary received a $200 refund

Q79: Fran purchased an annuity that provides $12,000

Q80: This year Mary received a $340 refund

Q82: This year, Fred and Wilma, married filing

Q83: Bernie is a former executive who is

Q84: Ethan competed in the annual Austin Marathon

Q85: Charles and Camillagot divorced in 2018. Under

Q86: This year, Barney and Betty sold their

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents