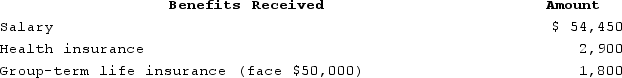

Frank received the following benefits from his employer this year. What amount must Frank include in his gross income?

A) $54,450

B) $57,350

C) $56,250

D) $59,150

E) $0-these benefits are excluded from gross income.

Correct Answer:

Verified

Q115: This year, Barney and Betty sold their

Q116: Acme published a story about Paul, and

Q117: Pam recently was sickened by eating spoiled

Q118: Hank is a U.S. citizen and is

Q119: In January of the current year, Dora

Q121: Aubrey and Justin file married filing separately.

Q122: Cyrus is a cash method taxpayer who

Q123: Acme published a story about Paul, and

Q124: This year Larry received the first payment

Q125: Juan works as a landscaper for local

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents