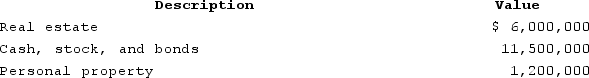

At his death in 2020, Nathan owned the following property:

The real estate is subject to a $1,825,000 mortgage and Nathan made taxable gifts in 2009 totaling $3.0 million, at which time he offset the gift tax with an applicable credit (exemption equivalent of $3.0 million). Nathan has never been married. What is the amount of his estate tax due? (Use Exhibit 25-1.)

The real estate is subject to a $1,825,000 mortgage and Nathan made taxable gifts in 2009 totaling $3.0 million, at which time he offset the gift tax with an applicable credit (exemption equivalent of $3.0 million). Nathan has never been married. What is the amount of his estate tax due? (Use Exhibit 25-1.)

Correct Answer:

Verified

Natha...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q127: Ricardo transferred $1,000,000 of cash to State

Q128: Ava transferred $1.5 million of real estate

Q129: This year Nicholas earned $580,000 and used

Q130: Gabriel had a taxable estate of $16

Q131: Joshua and David purchased real property for

Q133: Grace transferred $800,000 into trust with the

Q134: For the holidays, Samuel gave a necklace

Q135: Angel and Abigail are married and live

Q136: Adrian owns two parcels of real estate.

Q137: Sophia is single and owns the following

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents