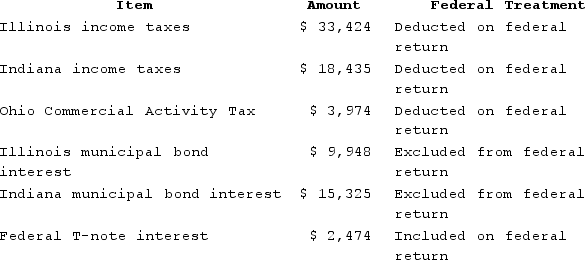

PWD Incorporated is an Illinois corporation. It properly included, deducted, or excluded the following items on its federal tax return in the current year:  PWD's federal taxable income was $113,000. If Illinois only requires Illinois taxes to be added back, calculate PWD's Illinois state tax base.

PWD's federal taxable income was $113,000. If Illinois only requires Illinois taxes to be added back, calculate PWD's Illinois state tax base.

A) $128,961

B) $143,411

C) $144,286

D) $159,275

Correct Answer:

Verified

Q77: Mahre, Incorporated, a New York corporation, runs

Q78: Public Law 86-272 protects solicitation from income

Q79: Mighty Manny, Incorporated manufactures ice scrapers and

Q80: In which of the following state cases

Q81: What was the Supreme Court's holding in

Q83: Lefty provides demolition services in several southern

Q84: Wacky Wendy produces gourmet cheese in Wisconsin.

Q85: Carolina's Hats has the following sales, payroll,

Q86: PWD Incorporated is an Illinois corporation. It

Q87: Which of the following is not a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents