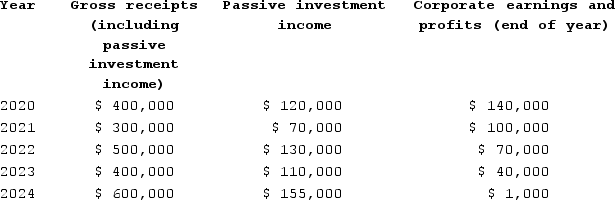

Neal Corporation was initially formed as a C corporation with a calendar year-end. Neal elected S corporation status, effective January 1, 2020. On December 31, 2019, Neal Corporation reported earnings and profits of $150,000. Beginning in 2020, Neal Corporation reported the following information. Does Neal Corporation's S election terminate due to excess net passive income? If so, what is the effective date of the termination?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q116: Assume that Clampett, Incorporated, has $240,000 of

Q117: Clampett, Incorporated, converted to an S corporation

Q118: Shea, an individual, is a 100percent owner

Q119: Clampett, Incorporated, converted to an S corporation

Q120: Assume that at the end of 2020,

Q122: CB Corporation was formed as a calendar-year

Q123: Jackson is the sole owner of JJJ

Q124: Lamont is a 100percent owner of JKL

Q125: XYZ was formed as a calendar-year S

Q126: CB Corporation was formed as a calendar-year

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents