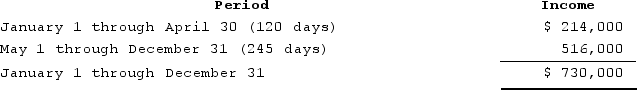

ABC was formed as a calendar-year S corporation with Alan, Brenda, and Conner as equal shareholders. On May 1, 2020, ABC's S election was terminated after Conner sold his ABC shares (one-third of all shares)to his solely owned C corporation, Conner, Incorporated ABC reported business income for 2020 as follows: (Assume that there are 365 days in the year.)

If ABC uses the specific identification method to allocate income, how much will it allocate to the S corporation short year and C corporation short year?

If ABC uses the specific identification method to allocate income, how much will it allocate to the S corporation short year and C corporation short year?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q128: CB Corporation was formed as a calendar-year

Q129: Jackson is the sole owner of JJJ

Q130: Lamont is a 100percent owner of JKL

Q131: ABC was formed as a calendar-year S

Q132: CB Corporation was formed as a calendar-year

Q134: At the beginning of the year, Harold,

Q135: Hector formed H Corporation as a C

Q136: ABC was formed as a calendar-year S

Q137: ABC was formed as a calendar-year S

Q138: Parker is a 100percent shareholder of Johnson

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents