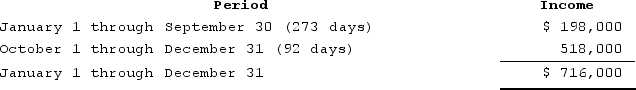

CB Corporation was formed as a calendar-year S corporation. Casey is a 60percent shareholder and Bryant is a 40percent shareholder. On September 30, 2020, Bryant sold his CB shares to Don. CB reported business income for 2020 as follows: (Assume that there are 365 days in the year.)

How much 2020 income is allocated to each shareholder if CB uses its normal accounting rules to allocate income to the specific periods in which it was actually earned?

How much 2020 income is allocated to each shareholder if CB uses its normal accounting rules to allocate income to the specific periods in which it was actually earned?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q117: Clampett, Incorporated, converted to an S corporation

Q118: Shea, an individual, is a 100percent owner

Q119: Clampett, Incorporated, converted to an S corporation

Q120: Assume that at the end of 2020,

Q121: Neal Corporation was initially formed as a

Q123: Jackson is the sole owner of JJJ

Q124: Lamont is a 100percent owner of JKL

Q125: XYZ was formed as a calendar-year S

Q126: CB Corporation was formed as a calendar-year

Q127: XYZ Corporation (an S corporation)is owned by

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents