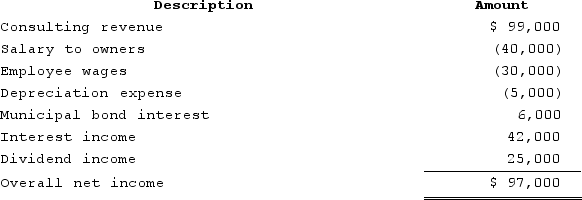

RGD Corporation was a C corporation from its inception in 2015 through 2019. However, it elected S corporation status effective January 1, 2020. RGD had $50,000 of earnings and profits at the end of 2019. RGD reported the following information for its 2020 tax year.

What amount of excess net passive income tax is RGD liable for in 2020? Assume the corporate tax rate is 21%.

What amount of excess net passive income tax is RGD liable for in 2020? Assume the corporate tax rate is 21%.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q137: ABC was formed as a calendar-year S

Q138: Parker is a 100percent shareholder of Johnson

Q139: XYZ Corporation (an S corporation)is owned by

Q140: Jackson is the sole owner of JJJ

Q141: During 2020, MVC operated as a C

Q143: During 2020, CDE Corporation (an S corporation

Q144: MWC is a C corporation that uses

Q145: Hazel is the sole shareholder of Maple

Q146: RGD Corporation was a C corporation from

Q147: SEC Corporation has been operating as a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents