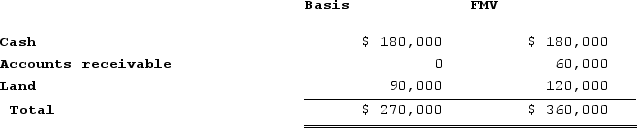

The SSC, a cash-method partnership, has a balance sheetthat includes the following assets on December 31 of the current year:  Susan, a one-third partner, has an adjusted basis of $90,000 for her partnership interest. If Susan sells her entire partnership interest to Emma for $120,000 cash, how much capital gain and ordinary income must Susan recognize from the sale?

Susan, a one-third partner, has an adjusted basis of $90,000 for her partnership interest. If Susan sells her entire partnership interest to Emma for $120,000 cash, how much capital gain and ordinary income must Susan recognize from the sale?

A) $30,000 ordinary income.

B) $30,000 capital gain.

C) $10,000 ordinary income; $20,000 capital gain.

D) $10,000 capital gain; $20,000 ordinary income.

Correct Answer:

Verified

Q21: Under which of the following circumstances will

Q22: Shauna is a 50 percent partner in

Q23: A partner recognizes a loss when she

Q24: Under which of the following circumstances will

Q25: Martha is a 40percent partner in the

Q27: Daniel acquires a 30percent interest in the

Q28: Daniel acquires a 30percent interest in the

Q29: Which of the following statements regarding the

Q30: At the end of last year, Cynthia,

Q31: At the end of last year, Cynthia,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents