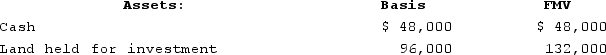

Kathy purchases a one-third interest in the KDP Partnership from Paul for $60,000. Just prior to the sale, Paul's outside and inside bases in KDP are $48,000. KDP's balance sheet includes the following:

If KDP has a §754 election in place, what is Kathy's special basis adjustment?

If KDP has a §754 election in place, what is Kathy's special basis adjustment?

A) $0.

B) $36,000.

C) $12,000.

D) None of the choices are correct.

Correct Answer:

Verified

Q65: Tyson is a 25percent partner in the

Q66: Daniela is a 25percent partner in the

Q67: Which of the following statements regarding disproportionate

Q68: Kathy is a 25percent partner in the

Q69: Which of the following statements regarding liquidating

Q71: Which of the following statements regarding hot

Q72: The PW Partnership's balance sheet includes the

Q73: Daniela is a 25percent partner in the

Q74: Kathy is a 25percent partner in the

Q75: Daniela is a 25percent partner in the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents