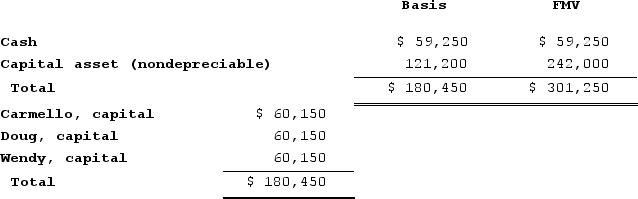

Carmello is a one-third partner in the CDW Partnership with equal inside and outside bases. On December 31, Carmello sells his interest to Conrad for $104,000 cash. CDW makes a §754 election and its balance sheet as of December 31 is as follows: (Do not round intermediate calculations. Round your final answer to the nearest whole dollar amount.)

What is the amount and sign (positive or negative)of Conrad's special basis adjustment? If CDW sells the capital asset next year for $298,800, what is the amount of gain Conrad will recognize because of the sale?

What is the amount and sign (positive or negative)of Conrad's special basis adjustment? If CDW sells the capital asset next year for $298,800, what is the amount of gain Conrad will recognize because of the sale?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q105: Lola is a 35percent partner in the

Q106: Tyson, a one-quarter partner in the TF

Q107: Tyson, a one-quarter partner in the TF

Q108: Nadine Fimple is a one-third partner in

Q109: Esther and Elizabeth are equal partners in

Q111: BPA Partnership is an equal partnership in

Q112: Nadine Fimple is a one-half partner in

Q113: Nadine Fimple is a one-half partner in

Q114: Esther and Elizabeth are equal partners in

Q115: Tyson, a one-quarter partner in the TF

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents