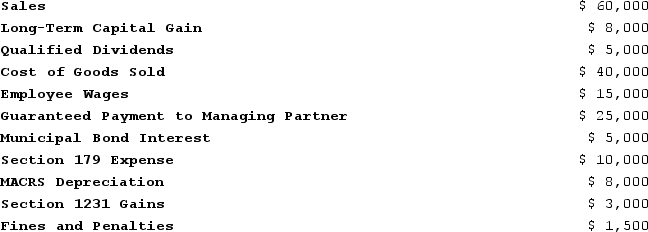

Illuminating Light Partnership had the following revenues, expenses, gains, losses, and distributions:

Given these items, what is Illuminating Light's ordinary business income (loss)for the year?

Given these items, what is Illuminating Light's ordinary business income (loss)for the year?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q103: Greg, a 40percent partner in GSS Partnership,

Q104: Ruby's tax basis in her partnership interest

Q105: Jordan, Incorporated, Bird, Incorporated, Ewing, Incorporated, and

Q106: Illuminating Light Partnership had the following revenues,

Q107: Ruby's tax basis in her partnership interest

Q109: Lloyd and Harry, equal partners, form the

Q110: Lincoln, Incorporated, Washington, Incorporated, and Adams, Incorporated,

Q111: What general accounting methods may be used

Q112: This year, Reggie's distributive share from Almonte

Q113: ER General Partnership, a medical supplies business,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents