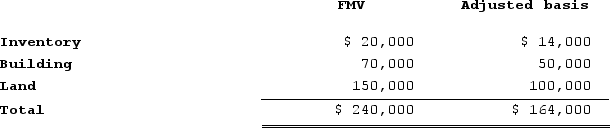

Keegan incorporated his sole proprietorship by transferring inventory, a building, and land to the corporation in return for 100 percent of the corporation's stock. The property transferred to the corporation had the following fair market values and tax-adjusted bases.

The fair market value of the corporation's stock received in the exchange equaled the fair market value of the assets transferred to the corporation by Keegan.

The fair market value of the corporation's stock received in the exchange equaled the fair market value of the assets transferred to the corporation by Keegan.

Assuming the gain or loss realized in this problem is deferred under §351, what is Keegan's basis in the stock he receives in his corporation?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q86: Paladin Corporation transferred its 90 percent interest

Q87: Ken and Jim agree to go into

Q88: Katarina transferred her 10 percent interest to

Q89: Phillip incorporated his sole proprietorship by transferring

Q90: In December 2019, Zeb incurred a $100,000

Q92: Packard Corporation transferred its 100 percent interest

Q93: Which of the following statements best describes

Q94: Billie transferred her 20 percent interest to

Q95: Robin transferred her 60 percent interest to

Q96: Packard Corporation transferred its 100 percent interest

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents