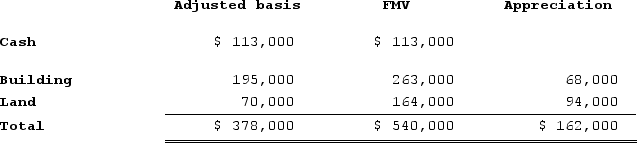

Gary and Laura decided to liquidate their jointly owned corporation, Amelia, Incorporated. After liquidating its remaining inventory and paying off its remaining liabilities, Amelia had the following tax accounting balance sheet.

Under the terms of the agreement, Gary will receive the $113,000 cash in exchange for his interest in Amelia. Gary's tax basis in his Amelia stock is $45,200. Laura will receive the building and land in exchange for her interest in Amelia. Laura's tax basis in her Amelia stock is $90,400.

Under the terms of the agreement, Gary will receive the $113,000 cash in exchange for his interest in Amelia. Gary's tax basis in his Amelia stock is $45,200. Laura will receive the building and land in exchange for her interest in Amelia. Laura's tax basis in her Amelia stock is $90,400.

What amount of gain or loss does Gary recognize in the complete liquidation?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q110: Mike and Michelle decided to liquidate their

Q111: Mike and Michelle decided to liquidate their

Q112: Mike and Michelle decided to liquidate their

Q113: Gary and Laura decided to liquidate their

Q114: April transferred 100 percent of her stock

Q116: Jasmine transferred 100 percent of her stock

Q117: Mike and Michelle decided to liquidate their

Q118: Rich and Rita propose to have their

Q119: Mike and Michelle decided to liquidate their

Q120: The City of Boston made a capital

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents