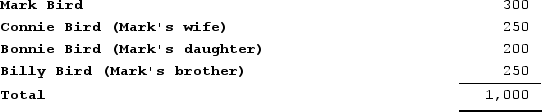

Tiger Corporation, a privately held company, has one class of voting common stock, of which 1,000 shares are issued and outstanding. The shares are owned as follows:

How many shares of stock is Mark deemed to own under the family attribution rules in a stock redemption?

How many shares of stock is Mark deemed to own under the family attribution rules in a stock redemption?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q105: Sunapee Corporation reported taxable income of $720,000

Q106: Townsend Corporation declared a 1-for-1 stock split

Q107: Buckeye Company is owned equally by James

Q108: Sherburne Corporation reported current E&P for 20X3

Q109: Crystal, Incorporated is owned equally by John

Q111: Sunapee Corporation reported taxable income of $700,000

Q112: Sweetwater Corporation declared a stock distribution to

Q113: Half Moon Corporation made a distribution of

Q114: Tappan declared a 100 percent stock distribution

Q115: Townsend Corporation declared a 1-for-1 stock split

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents