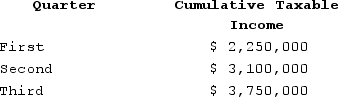

In the current year, Auto Rent Corporation reported the following taxable income at the end of its first, second, and third quarters: (Use Exhibit 16-10)

What amount of estimated tax payments would Auto Rent pay each quarter to avoid estimated tax penalties under the annualized income method of computing estimated tax payments?

What amount of estimated tax payments would Auto Rent pay each quarter to avoid estimated tax penalties under the annualized income method of computing estimated tax payments?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q116: During 2020, Hughes Corporation sold a portfolio

Q117: AB Incorporated received a dividend from CD

Q118: Datasoft Incorporated received $350,000 in dividends from

Q119: Rapidpro Incorporated had more than $1,000,000 of

Q120: On January 1, 2020, Credit Incorporated recorded

Q121: AR Systems Incorporated (AR)had $120,000 of tax

Q122: LuxAir Incorporated (LA)has book income of $166,000.

Q123: In the current year, Auto Rent Corporation

Q125: LuxAir Incorporated (LA)has book income of $160,000.

Q126: Netgate Corporation's gross regular tax liability for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents