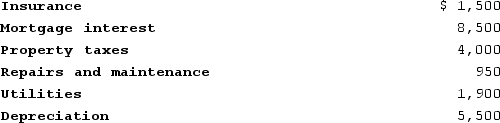

Careen owns a condominium near Newport Beach in California. This year, she incurs the following expenses in connection with her condo: (Round your intermediate and final answer to whole number.)

During the year, Careen rented the condo for 90 days, receiving $20,000 of gross income. She personally used the condo for 50 days. Careen itemizes deductions, and the sum of her itemized deduction for non-home business taxes and the real property taxes allocated to business use of the home is less than $10,000. Assume Careen uses the IRS method of allocating expenses to rental use of the property. What is Careen's net rental income for the year?

During the year, Careen rented the condo for 90 days, receiving $20,000 of gross income. She personally used the condo for 50 days. Careen itemizes deductions, and the sum of her itemized deduction for non-home business taxes and the real property taxes allocated to business use of the home is less than $10,000. Assume Careen uses the IRS method of allocating expenses to rental use of the property. What is Careen's net rental income for the year?

Correct Answer:

Verified

See calculations below:

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q110: Careen owns a condominium near Newport Beach

Q111: Joshua and Mary Sullivan purchased a new

Q112: Several years ago, Chara acquired a home

Q113: Amelia is looking to refinance her home

Q114: Tyson owns a condominium near Laguna Beach,

Q116: Jason and Alicia Johnston purchased a home

Q117: Leticia purchased a home on July 1,

Q118: Leticia purchased a home on July 1,

Q119: Jasper is looking to purchase a new

Q120: Kristen rented out her home for 10

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents