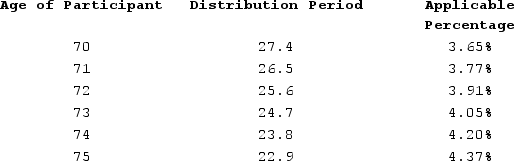

Sean (age 72 at end of 2020)retired five years ago. The balance in his 401(k)account on December 31, 2019, was $1,760,000 and the balance in his account on December 31, 2020, was $1,825,000. In 2020, Sean received a distribution of $65,000 from his 401(k)account(not a coronavirus-related distribution). Assuming Sean's marginal tax rate is 25 percent, what amount of the $65,000 distribution will Sean have left after paying income tax on the distribution and paying any minimum distribution penalties (use the Treasury table below in determining the required minimum distribution penalty, if any).

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q118: Georgeanne has been employed by SEC Corporation

Q119: Which of the following taxpayers is most

Q120: Heidi (age 57)invested $4,000 in her Roth

Q121: In 2020, Madison is a single taxpayer

Q122: Cassandra, age 33, has made deductible contributions

Q124: Sean (age 71 at end of 2020)retired

Q125: Sean (age 74 at end of 2020)retired

Q126: In 2020, Madison is a single taxpayer

Q127: In 2020, Tyson (age 52)earned $50,000 of

Q128: Katrina's executive compensation package allows her to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents