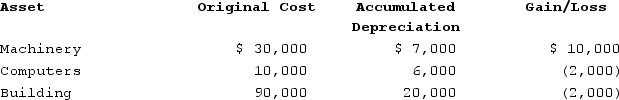

Brandon, an individual, began business four years ago and has never sold a §1231 asset. Brandon owned each of the assets for several years. In the current year, Brandon sold the following business assets:  Assuming Brandon's marginal ordinary income tax rate is 32 percent, what effect do the gains and losses have on Brandon's tax liability?

Assuming Brandon's marginal ordinary income tax rate is 32 percent, what effect do the gains and losses have on Brandon's tax liability?

A) $7,000 ordinary income, $1,000 §1231 loss, and $1,920 tax liability.

B) $6,000 ordinary income and $1,920 tax liability.

C) $7,000 §1231 gain and $2,240 tax liability.

D) $7,000 §1231 gain and $1,050 tax liability.

E) None of the choices are correct.

Correct Answer:

Verified

Q75: Alpha sold machinery that it used in

Q76: Brad sold a rental house that he

Q77: Brad sold a rental house that he

Q78: When do unrecaptured §1250 gains apply?

A)When the

Q79: Which of the following is not true

Q81: A deferred like-kind exchange does not help

Q82: Sadie sold 10 shares of stock to

Q83: Jessie sold a piece of land held

Q84: How long after the initial exchange does

Q85: Peroni Corporation sold a parcel of land

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents