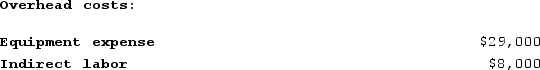

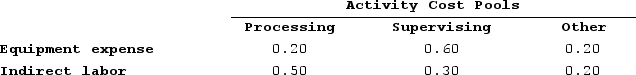

Bartow Corporation uses an activity based costing system to assign overhead costs to products. In the first stage, two overhead costs--equipment expense and indirect labor--are allocated to the three activity cost pools--Processing, Supervising, and Other--based on resource consumption. Data to perform these allocations appear below:  Distribution of Resource Consumption Across Activity Cost Pools:

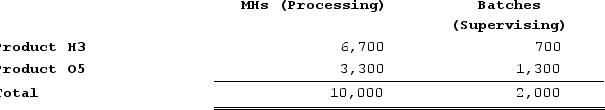

Distribution of Resource Consumption Across Activity Cost Pools: In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity:

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity: What is the overhead cost assigned to Product H3 under activity-based costing?

What is the overhead cost assigned to Product H3 under activity-based costing?

A) $6,930

B) $13,496

C) $18,500

D) $6,566

Correct Answer:

Verified

Q120: The following data have been provided by

Q121: Deemer Corporation has an activity-based costing system

Q122: Bartow Corporation uses an activity based costing

Q123: Meester Corporation has an activity-based costing system

Q124: Goertz Corporation has an activity-based costing system

Q126: Addleman Corporation has an activity-based costing system

Q127: Deemer Corporation has an activity-based costing system

Q128: Deemer Corporation has an activity-based costing system

Q129: Meester Corporation has an activity-based costing system

Q130: Deemer Corporation has an activity-based costing system

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents