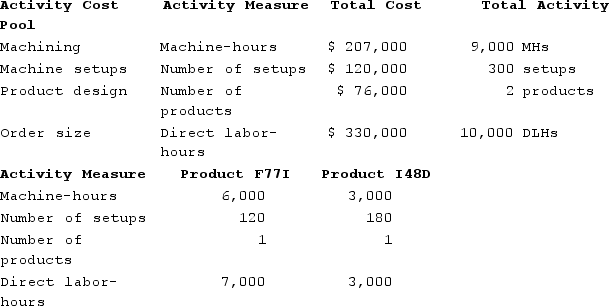

Vito Corporation manufactures two products: Product F77I and Product I48D. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products F77I and I48D.

Required:a. What is the company's plantwide overhead rate?b. Using the plantwide overhead rate, how much manufacturing overhead cost would be allocated to Product F77I?c. Using the plantwide overhead rate, what percentage of the total overhead cost is allocated to Product I48D?

Required:a. What is the company's plantwide overhead rate?b. Using the plantwide overhead rate, how much manufacturing overhead cost would be allocated to Product F77I?c. Using the plantwide overhead rate, what percentage of the total overhead cost is allocated to Product I48D?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q303: Hagy Corporation has an activity-based costing system

Q304: Lemaire Corporation is conducting a time-driven activity-based

Q305: Figge and Mathews PLC, a consulting firm,

Q306: Desilets Corporation has provided the following data

Q307: Howell Corporation's activity-based costing system has three

Q309: Aresco Corporation manufactures two products: Product G51B

Q310: Lemaire Corporation is conducting a time-driven activity-based

Q311: Ledonne Corporation is conducting a time-driven activity-based

Q312: Beckley Corporation has provided the following data

Q313: Losser Corporation manufactures two products: Product L73Z

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents