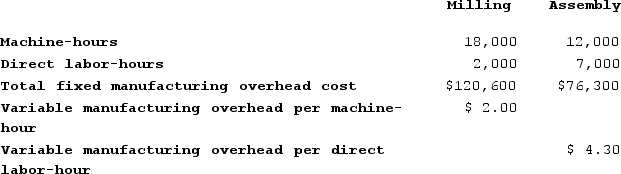

Boward Corporation has two production departments, Milling and Assembly. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Milling Department's predetermined overhead rate is based on machine-hours and the Assembly Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:  During the current month the company started and finished Job T818. The following data were recorded for this job:

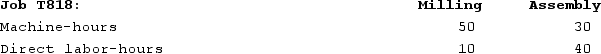

During the current month the company started and finished Job T818. The following data were recorded for this job: The total amount of overhead applied in both departments to Job T818 is closest to: (Round your intermediate calculations to 2 decimal places.)

The total amount of overhead applied in both departments to Job T818 is closest to: (Round your intermediate calculations to 2 decimal places.)

A) $1,651

B) $608

C) $435

D) $1,043

Correct Answer:

Verified

Q69: Sutter Corporation uses a job-order costing system

Q70: Atteberry Corporation has two manufacturing departments--Machining and

Q71: Ashe Corporation has two manufacturing departments--Machining and

Q72: Molash Corporation has two manufacturing departments--Machining and

Q73: Mahon Corporation has two production departments, Casting

Q75: Malakan Corporation has two production departments, Machining

Q76: Marioni Corporation has two manufacturing departments--Forming and

Q77: Fatzinger Corporation has two production departments, Milling

Q78: Tarrant Corporation has two manufacturing departments--Casting and

Q79: Placker Corporation uses a job-order costing system

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents