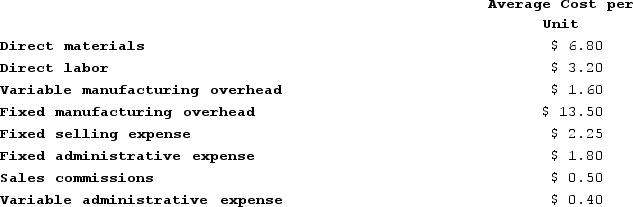

Balerio Corporation's relevant range of activity is 7,000 units to 11,000 units. When it produces and sells 9,000 units, its average costs per unit are as follows:

Required:a. For financial reporting purposes, what is the total amount of product costs incurred to make 9,000 units? (Do not round intermediate calculations.)b. If 10,000 units are sold, what is the variable cost per unit sold? (Round "Per unit" answer to 2 decimal places.)c. If 10,000 units are sold, what is the total amount of variable costs related to the units sold? (Do not round intermediate calculations. Round "Per unit" answer to 2 decimal places.)d. If the selling price is $18.20 per unit, what is the contribution margin per unit sold? (Round "Per unit" answer to 2 decimal places.)e. What incremental manufacturing cost will the company incur if it increases production from 9,000 to 9,001 units? (Round "Per unit" answer to 2 decimal places.)

Required:a. For financial reporting purposes, what is the total amount of product costs incurred to make 9,000 units? (Do not round intermediate calculations.)b. If 10,000 units are sold, what is the variable cost per unit sold? (Round "Per unit" answer to 2 decimal places.)c. If 10,000 units are sold, what is the total amount of variable costs related to the units sold? (Do not round intermediate calculations. Round "Per unit" answer to 2 decimal places.)d. If the selling price is $18.20 per unit, what is the contribution margin per unit sold? (Round "Per unit" answer to 2 decimal places.)e. What incremental manufacturing cost will the company incur if it increases production from 9,000 to 9,001 units? (Round "Per unit" answer to 2 decimal places.)

Correct Answer:

Verified

...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q317: Boersma Sales, Incorporated a merchandising company, reported

Q318: Salomon Marketing, Incorporated a merchandising company, reported

Q319: Salomon Marketing, Incorporated a merchandising company, reported

Q320: Streif Incorporated a local retailer, has provided

Q321: In April, Holderness Incorporated, a merchandising company,

Q323: In April, Holderness Incorporated, a merchandising company,

Q324: Glisan Corporation's relevant range of activity is

Q325: Asplund Corporation has provided the following information:

Q326: Mary Tappin, an assistant Vice President at

Q327: Menk Corporation has provided the following information:

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents