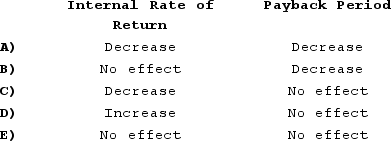

Rennin Dairy Corporation is considering a plant expansion decision that has an estimated useful life of 20 years. This project has an internal rate of return of 15% and a payback period of 9.6 years. How would a decrease in the expected salvage value from this project in 20 years affect the following for this project?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

E) Choice E

Correct Answer:

Verified

Q45: A company with $810,000 in operating assets

Q46: The assumption that the cash flows from

Q47: A preference decision in capital budgeting:

A) is

Q48: The internal rate of return method assumes

Q49: The Zingstad Corporation is considering an investment

Q51: Buy-Rite Pharmacy has purchased a small auto

Q52: If the net present value of a

Q53: Olinick Corporation is considering a project that

Q54: Jarvey Corporation is studying a project that

Q55: The management of Lanzilotta Corporation is considering

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents