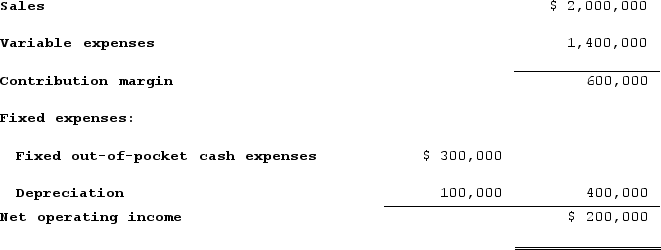

Ursus, Incorporated, is considering a project that would have a ten-year life and would require a $1,000,000 investment in equipment. At the end of ten years, the project would terminate and the equipment would have no salvage value. The project would provide net operating income each year as follows (Ignore income taxes.):

All of the above items, except for depreciation, represent cash flows. The company's required rate of return is 12%.Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using the tables provided.Required:a. Compute the project's net present value.b. Compute the project's internal rate of return to the nearest whole percent.c. Compute the project's payback period.d. Compute the project's simple rate of return.

All of the above items, except for depreciation, represent cash flows. The company's required rate of return is 12%.Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using the tables provided.Required:a. Compute the project's net present value.b. Compute the project's internal rate of return to the nearest whole percent.c. Compute the project's payback period.d. Compute the project's simple rate of return.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q351: Cooney Incorporated has provided the following data

Q352: Wary Corporation is considering the purchase of

Q353: Hady Corporation is considering purchasing a machine

Q354: Bill Anders is considering investing in a

Q355: The management of Truelove Corporation is considering

Q357: Strausberg Incorporated is considering investing in a

Q358: Cardinal Pharmacy has purchased a small auto

Q359: Mattice Corporation is considering investing $440,000 in

Q360: The following data concern an investment project

Q361: Maxcy Limos, Incorporated, is considering the purchase

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents