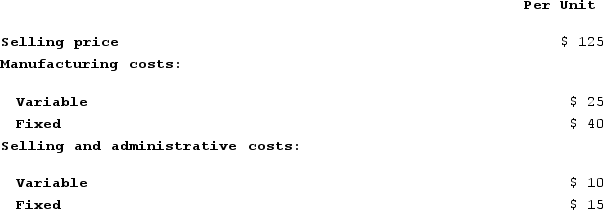

CoolAir Corporation manufactures portable window air conditioners. CoolAir has the capacity to manufacture and sell 80,000 air conditioners each year but is currently only manufacturing and selling 60,000. The following per unit numbers relate to annual operations at 60,000 units:  The City of Clearwater would like to purchase 3,000 air conditioners from CoolAir but only if they can get them for $75 each. Variable selling and administrative costs on this special order will drop down to $2 per unit. This special order will not affect the 60,000 regular sales and it will not affect the total fixed costs. The annual financial advantage (disadvantage) for the company as a result of accepting this special order from the City of Clearwater should be:

The City of Clearwater would like to purchase 3,000 air conditioners from CoolAir but only if they can get them for $75 each. Variable selling and administrative costs on this special order will drop down to $2 per unit. This special order will not affect the 60,000 regular sales and it will not affect the total fixed costs. The annual financial advantage (disadvantage) for the company as a result of accepting this special order from the City of Clearwater should be:

A) ($21,000)

B) $24,000

C) $144,000

D) ($129,000)

Correct Answer:

Verified

Q115: An automated turning machine is the current

Q116: Gallerani Corporation has received a request for

Q117: Sardi Incorporated is considering whether to continue

Q118: Banfield Corporation makes three products that use

Q119: An automated turning machine is the current

Q121: Two products, QI and VH, emerge from

Q122: Faustina Chemical Corporation manufactures three chemicals (TX14,

Q123: Drew Cane Products, Incorporated, processes sugar cane

Q124: WP Corporation produces products X, Y, and

Q125: The Wyeth Corporation produces three products, A,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents