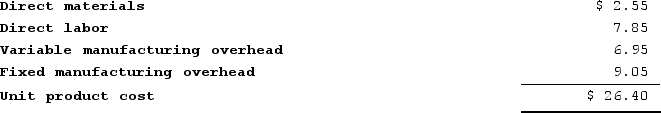

Gallerani Corporation has received a request for a special order of 4,300 units of product A90 for $26.90 each. Product A90's unit product cost is $26.40, determined as follows:  Assume that direct labor is a variable cost. The special order would have no effect on the company's total fixed manufacturing overhead costs. The customer would like modifications made to product A90 that would increase the variable costs by $3.30 per unit and that would require an investment of $22,000 in special molds that would have no salvage value. This special order would have no effect on the company's other sales. The company has ample spare capacity for producing the special order. The annual financial advantage (disadvantage) for the company as a result of accepting this special order should be:

Assume that direct labor is a variable cost. The special order would have no effect on the company's total fixed manufacturing overhead costs. The customer would like modifications made to product A90 that would increase the variable costs by $3.30 per unit and that would require an investment of $22,000 in special molds that would have no salvage value. This special order would have no effect on the company's other sales. The company has ample spare capacity for producing the special order. The annual financial advantage (disadvantage) for the company as a result of accepting this special order should be:

A) $(34,040)

B) $4,875

C) $2,150

D) $(54,610)

Correct Answer:

Verified

Q98: Part S51 is used in one of

Q99: The management of Furrow Corporation is considering

Q100: The Cook Corporation has two divisions--East and

Q101: The SP Corporation makes 40,000 motors to

Q102: Gordon Corporation produces 1,000 units of a

Q104: Supler Corporation produces a part used in

Q105: A customer has requested that Lewelling Corporation

Q106: Wood Carving Corporation manufactures three products. Because

Q107: Sardi Incorporated is considering whether to continue

Q108: Supler Corporation produces a part used in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents