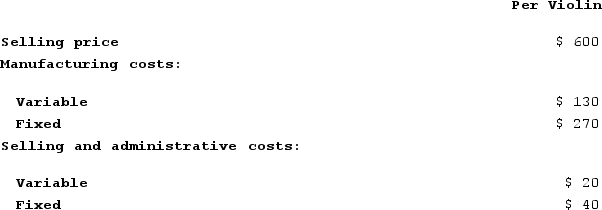

The Bharu Violin Corporation has the capacity to manufacture and sell 5,000 violins each year but is currently only manufacturing and selling 4,800. The following data relate to annual operations at 4,800 units:  Woolgar Symphony Orchestra is interested in purchasing Bharu's excess capacity of 200 units but only if they can get the violins for $350 each. This special order would not affect regular sales or the total fixed costs.If the special order from Woolgar Symphony Orchestra is accepted, the financial advantage (disadvantage) Bharu for the year should be:

Woolgar Symphony Orchestra is interested in purchasing Bharu's excess capacity of 200 units but only if they can get the violins for $350 each. This special order would not affect regular sales or the total fixed costs.If the special order from Woolgar Symphony Orchestra is accepted, the financial advantage (disadvantage) Bharu for the year should be:

A) $40,000

B) ($10,000)

C) ($22,000)

D) ($28,000)

Correct Answer:

Verified

Q156: Ouzts Corporation is considering Alternative A and

Q157: The management of Woznick Corporation has been

Q158: Key Corporation is considering the addition of

Q159: The Draper Corporation is considering dropping its

Q160: Two alternatives, code-named X and Y, are

Q162: Mcfarlain Corporation is presently making part U98

Q163: Mcfarlain Corporation is presently making part U98

Q164: Melbourne Corporation has traditionally made a subcomponent

Q165: Penagos Corporation is presently making part Z43

Q166: The management of Woznick Corporation has been

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents