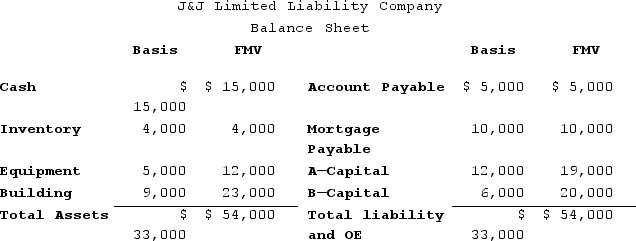

J&J, LLC, was in its third year of operations when J&J decided to expand the number of members from two, A and B, with equal profits and capital interests, to three members, A, B, and C. The third member, C, will contribute her financial expertise to the LLC in exchange for a one-third capital interest in J&J. Given the balance sheet below reflecting the financial position of J&J on the date member C is admitted, what are the tax consequences to members A, B, and C, and to J&J, when C receives her capital interest? If, instead, member C receives a one-third profits interest, what would be the tax consequences to members A, B, and C, and to J&J?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q80: Hilary had an outside basis in LTL

Q83: John, a limited partner of Candy Apple,

Q86: On April 18, 20X8, Robert sold his

Q88: J&J, LLC, was in its third year

Q88: In each of the independent scenarios below,

Q89: Which of the following statements regarding partnership

Q89: John, a limited partner of Candy Apple,

Q90: Jay has a tax basis of $14,000

Q95: What type of debt is not included

Q100: Which of the following would not be

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents