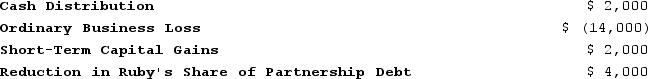

Ruby's tax basis in her partnership interest at the beginning of the partnership's tax year was $13,000. The following items were included in her Schedule K-1 from the partnership for the year:

Determine what amounts related to these items Ruby will report on her tax return assuming her tax basis and at-risk amount are equal and that she is a material participant in the partnership's activities. Further, assume that Ruby and her husband, Gerald, are not involved in any other trade or business and that they file a joint return every year.

Determine what amounts related to these items Ruby will report on her tax return assuming her tax basis and at-risk amount are equal and that she is a material participant in the partnership's activities. Further, assume that Ruby and her husband, Gerald, are not involved in any other trade or business and that they file a joint return every year.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q82: On March 15, 20X9, Troy, Peter, and

Q97: Which person would generally be treated as

Q98: On March 15, 20X9, Troy, Peter, and

Q99: On January 1, X9, Gerald received his

Q103: At the end of Year 1, Tony

Q104: ER General Partnership, a medical supplies business,

Q105: ER General Partnership, a medical supplies business,

Q107: This year, Reggie's distributive share from Almonte

Q111: What general accounting methods may be used

Q119: Why are guaranteed payments deducted in calculating

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents