Alfred, a one-third profits and capital partner in Pizzeria Partnership, needs help in adjusting his tax basis to reflect the information contained in his most recent Schedule K-1 from the partnership. Unfortunately, the Schedule K-1 he recently received was for Year 3 of the partnership, but Alfred only knows that his tax basis at the beginning of Year 2 of the partnership was $23,140. Thankfully, Alfred still has his Schedule K-1 from the partnership for Years 1 and 2.

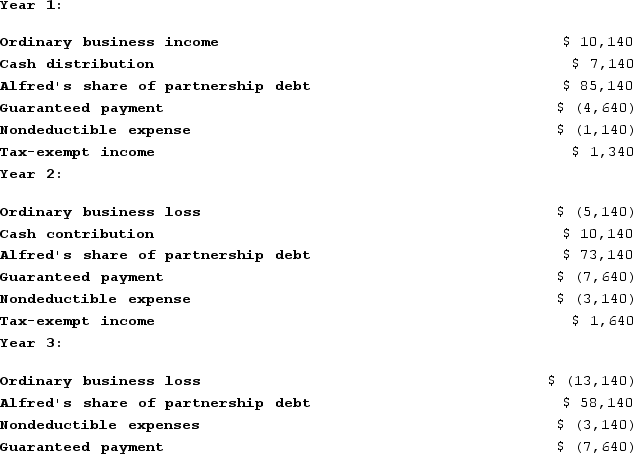

Using the following information from Alfred's Year 1, Year 2, and Year 3 Schedule K-1, calculate his tax basis the end of Year 2 and Year 3.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q121: Explain why partners must increase their tax

Q122: Bob is a general partner in Fresh

Q123: What is the difference between a partner's

Q124: On January 1, 20X9, Mr. Blue and

Q125: Fred has a 45 percent profits interest

Q126: Clint noticed that the Schedule K-1 he

Q126: Peter, Matt, Priscilla, and Mary began the

Q127: Fred has a 45percent profits interest and

Q127: On January 1, 20X9, Mr. Blue and

Q129: Clint noticed that the Schedule K-1 he

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents