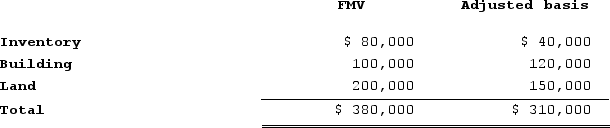

Zhao incorporated her sole proprietorship by transferring inventory, a building, and land to the corporation in return for 100 percent of the corporation's stock. The property transferred to the corporation had the following fair market values and tax-adjusted bases.

The corporation also assumed a mortgage of $50,000 attached to the building and land. The fair market value of the corporation's stock received in the exchange was $330,000. The transaction met the requirements to be tax-deferred under §351.

The corporation also assumed a mortgage of $50,000 attached to the building and land. The fair market value of the corporation's stock received in the exchange was $330,000. The transaction met the requirements to be tax-deferred under §351.

a. What amount of gain or loss does Zhao realize on the transfer of the property to her corporation?

b. What amount of gain or loss does Zhao recognize on the transfer of the property to her corporation?

c. What is the corporation's adjusted basis in each of the assets received in the exchange?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q81: Ken and Jim agree to go into

Q82: In December 2019, Jill incurred a $50,000

Q83: Robin transferred her 60 percent interest to

Q88: Robin transferred her 60 percent interest to

Q88: Katarina transferred her 10 percent interest to

Q91: Don and Marie formed Paper Lilies Corporation

Q92: Packard Corporation transferred its 100 percent interest

Q92: Phillip incorporated his sole proprietorship by transferring

Q94: Billie transferred her 20 percent interest to

Q94: Packard Corporation transferred its 100 percent interest

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents