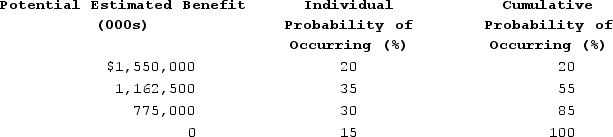

Morgan Corporation determined that $1,550,000 of the research credit on its current-year tax return was uncertain, but that it was more likely than not to be sustained on audit. Management made the following assessment of the company's potential tax benefit from the credit and its probability of occurring.

Under ASC 740, what amount of the tax benefit related to the research credit can Morgan recognize in calculating its income tax provision in the current year?

Under ASC 740, what amount of the tax benefit related to the research credit can Morgan recognize in calculating its income tax provision in the current year?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q101: DeWitt Corporation reported pretax book income of

Q103: Lafayette, Incorporated, completed its first year of

Q104: Farm Corporation reported pretax book loss of

Q110: Identify the following items as creating a

Q111: Acai Corporation determined that $5,000,000 of its

Q117: Irish Corporation reported pretax book income of

Q118: MAC, Incorporated, completed its first year of

Q118: Moody Corporation recorded the following deferred tax

Q119: Whitman Corporation reported pretax book income of

Q120: Stone Corporation reported pretax book income of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents