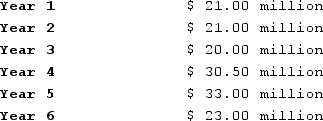

WFO Corporation has gross receipts according to the following schedule:  If WFO began business as a cash-method corporation in Year 1, in which year would it have first been required to use the accrual method?

If WFO began business as a cash-method corporation in Year 1, in which year would it have first been required to use the accrual method?

A) Year 3.

B) Year 4.

C) Year 5.

D) Year 6.

E) None of the choices are correct.

Correct Answer:

Verified

Q42: Coop Incorporated owns 40percent of Chicken Incorporated.

Q44: TrendSetter Incorporated paid $50,000 in premiums for

Q56: Coop Incorporated owns 38 percent of Chicken

Q56: Most corporations use the annualized income method

Q58: Corporation A receives a dividend from Corporation

Q59: Which of the following describes the correct

Q63: In January 2019, Khors Company issued nonqualified

Q64: Studios reported a net capital loss of

Q68: In January 2020, Khors Company issued nonqualified

Q70: BTW Corporation has taxable income in the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents