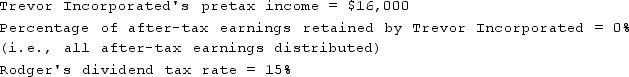

Rodger owns 100 percent of the shares in Trevor Incorporated a C corporation. Assume the following for the current year:

Given these assumptions, how much cash does Rodger have from the dividend after paying taxes on the distribution?

Given these assumptions, how much cash does Rodger have from the dividend after paying taxes on the distribution?

Correct Answer:

Verified

Q72: Roberto and Reagan are both 25-percent owner/managers

Q73: What is the maximum number of unrelated

Q74: Which of the following statements is true

Q77: Stacy would like to organize SST (a

Q80: The excess loss limitations apply to owners

Q81: A Corporation owns 10 percent of D

Q82: In 2020, Aspen Corporation reported $120,000 of

Q82: In 2020, Aspen Corporation reported $120,000 of

Q83: Rodger owns 100percent of the shares in

Q83: In 2020, BYC Corporation (a C corporation)had

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents