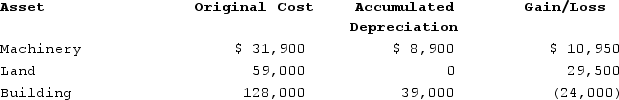

Brandon, an individual, began business four years ago and has sold §1231 assets with $5,950 of losses within the last five years. Brandon owned each of the assets for several years. In the current year, Brandon sold the following business assets:  Assuming Brandon's marginal ordinary income tax rate is 32 percent, what effect do the gains and losses have on Brandon's tax liability? Use dividends and capital gains tax rates for reference.

Assuming Brandon's marginal ordinary income tax rate is 32 percent, what effect do the gains and losses have on Brandon's tax liability? Use dividends and capital gains tax rates for reference.

A) $16,450 ordinary income and $5,264 tax liability.

B) $16,450 §1231 gain and $2,468 tax liability.

C) $1,600 §1231 gain, $14,850 ordinary income, and $4,992 tax liability.

D) $14,850 §1231 gain, $1,600 ordinary income, and $2,740 tax liability.

E) None of the choices are correct.

Correct Answer:

Verified

Q62: Maryexchanged an office building used in her

Q64: Which one of the following is not

Q66: Which one of the following is not

Q67: Which of the following is true regarding

Q74: Koch traded Machine 1 for Machine 2when

Q74: Brandon, an individual, began business four years

Q75: Alpha sold machinery that it used in

Q76: Alpha sold machinery that it used in

Q77: Brad sold a rental house that he

Q78: When do unrecaptured §1250 gains apply?

A)When the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents