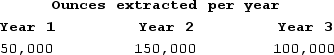

Lucky Strike Mine (LLC) purchased a silver deposit for $1,500,000. It estimated it would extract 500,000 ounces of silver from the deposit. Lucky Strike mined the silver and sold it, reporting gross receipts of $1.8 million, $2.5 million, and $2 million for Years 1 through 3, respectively. During Years 1 through 3, Lucky Strike reported net income (loss) from the silver deposit activity in the amount of ($100,000) , $400,000, and $100,000, respectively. In Years 1 through 3, Lucky Strike actually extracted 300,000 ounces of silver as follows:  What is Lucky Strike's depletion deduction for Year 2 if the applicable percentage depletion for silver is 15 percent?

What is Lucky Strike's depletion deduction for Year 2 if the applicable percentage depletion for silver is 15 percent?

A) $200,000

B) $375,000

C) $400,000

D) $450,000

E) None of the choices are correct.

Correct Answer:

Verified

Q63: Which of the following assets is not

Q69: Potomac LLC purchased an automobile for $30,000

Q78: Billie Bob purchased a used camera (five-year

Q79: Arlington LLC purchased an automobile for $55,000

Q80: Potomac LLC purchased an automobile for $31,200

Q83: Roth LLC purchased only one asset during

Q87: Jaussi purchased a computer several years ago

Q92: Jasmine started a new business in the

Q94: Taylor LLC purchased an automobile for $55,000

Q100: Jorge purchased a copyright for use in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents