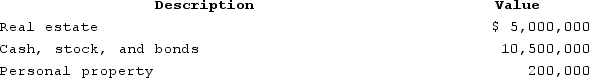

At his death in 2020, Nathan owned the following property:

The real estate is subject to a $1,700,000 mortgage and Nathan made taxable gifts in 2009 totaling $2 million, at which time he offset the gift tax with an applicable credit (exemption equivalent of $2 million). Nathan has never been married. What is the amount of his estate tax due? (Use Exhibit 14-1.)

The real estate is subject to a $1,700,000 mortgage and Nathan made taxable gifts in 2009 totaling $2 million, at which time he offset the gift tax with an applicable credit (exemption equivalent of $2 million). Nathan has never been married. What is the amount of his estate tax due? (Use Exhibit 14-1.)

Correct Answer:

Verified

Nathan...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q102: For the holidays, Samuel gave a necklace

Q106: Which of the following is a true

Q114: This year Maria transferred $600,000 to an

Q118: Ryan placed $350,000 in trust with income

Q122: This year Nicholas earned $500,000 and used

Q126: Sophia is single and owns the following

Q128: Ava transferred $1.5 million of real estate

Q133: Grace transferred $800,000 into trust with the

Q135: Angel and Abigail are married and live

Q138: Ashley owns a whole-life insurance policy worth

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents