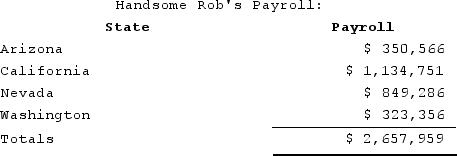

Handsome Rob provides transportation services in several western states. Rob has payroll as follows:  Rob is a California corporation and the following is true:

Rob is a California corporation and the following is true:

Rob hasincome tax nexus in Arizona, California, Nevada, and Washington. The Washington drivers spend 25 percent of their time driving through Oregon. California payroll includes $201,800 of payroll for services provided in Nevada by California-based drivers. What is Rob's California payroll numerator?

A) $932,951.

B) $1,134,751.

C) $1,215,401.

D) $2,657,959.

Correct Answer:

Verified

Q81: What was the Supreme Court's holding in

Q84: Lefty provides demolition services in several southern

Q86: Carolina's Hats has the following sales, payroll,

Q87: Which of the following is not a

Q90: Lefty provides demolition services in several southern

Q92: Wacky Wendy produces gourmet cheese in Wisconsin.

Q94: Which of the following is an income-based

Q95: Which of the following isn't a typical

Q97: Della Corporation is headquartered in Carlisle, Pennsylvania.

Q100: Which of the following is not a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents