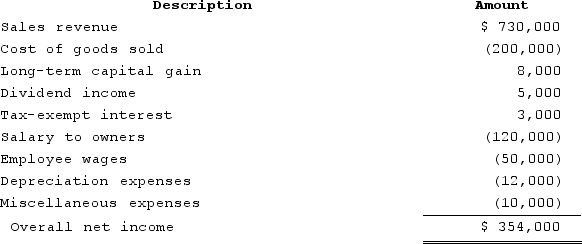

XYZ Corporation (an S corporation) is owned by Jane and Rebecca, who are each 50percent shareholders. At the beginning of the year, Jane's basis in her XYZ stock was $40,000. XYZ reported the following tax information for 2020.

Required:

Required:

a. What amount of ordinary business income is allocated to Jane?

b. What is the amount and character of separately stated items allocated to Jane?

c. What is Jane's basis in her XYZ Corporation stock at the end of the year?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q124: Lamont is a 100percent owner of JKL

Q125: XYZ was formed as a calendar-year S

Q133: ABC was formed as a calendar-year S

Q134: At the beginning of the year, Harold,

Q135: ABC was formed as a calendar-year S

Q136: XYZ Corporation (an S corporation) is owned

Q139: ABC was formed as a calendar-year S

Q140: Lamont is a 100percent owner of JKL

Q141: MWC is a C corporation that uses

Q142: During 2020, CDE Corporation (an S corporation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents