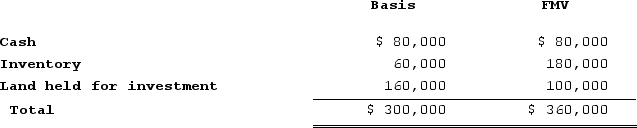

Shauna is a 50 percent partner in the SH Partnership. Shauna sells one-half of her interest to Kara for $60,000 cash. Just before the sale, Shauna's basis in her entire partnership interest is $150,000, including her $60,000 share of the partnership liabilities. SH's assets on the sale date are as follows:  What is the amount and character of Shauna's gain or loss on the sale?

What is the amount and character of Shauna's gain or loss on the sale?

A) $30,000 ordinary incomeand $15,000 capital loss.

B) $45,000 capital gain.

C) $15,000 capital loss.

D) $15,000 ordinary income and $30,000 capital gain.

Correct Answer:

Verified

Q7: A partner recognizes gain when she receives

Q8: Catherine is a 30percent partner in the

Q19: When determining a partner's gain onthe sale

Q24: Under which of the following circumstances will

Q26: The SSC Partnership, a cash-method partnership, has

Q27: Daniel acquires a 30percent interest in the

Q27: At the end of last year, Cynthia,

Q29: Which of the following statements regarding the

Q30: At the end of last year, Cynthia,

Q34: A §754 election is made by a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents