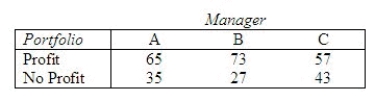

A study of the purchase decisions of three stock portfolio managers, A, B, C, was conducted to compare the numbers of stock purchases that resulted in profits over a time period less than or equal to 1 year. One hundred randomly selected purchases were examined for each of the managers.  Do the data provide evidence of differences among the rates of successful purchases for the three managers?

Do the data provide evidence of differences among the rates of successful purchases for the three managers?

Compute  = ______________

= ______________

The p-value is ______________.

Conclude that there ______________ enough information to conclude that the proportion of successful purchases will differ among the managers.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: The total degrees of freedom for an

Q3: Suppose you wish to test the null

Q4: If we want to perform a two-tail

Q5: To be valid, the chi-square test requires

Q6: When there are only 2 categories in

Q8: Numbers in a contingency table show the

Q9: The large-sample z tests for one and

Q10: If we want to conduct a two-tail

Q11: The chi-square technique is a statistical technique

Q12: The following table shows the results of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents