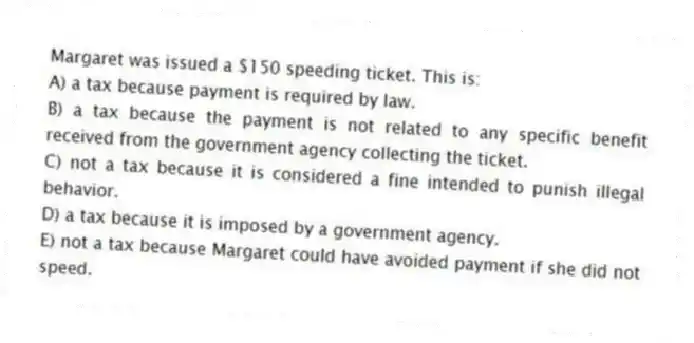

Margaret was issued a $150 speeding ticket. This is:

A) a tax because payment is required by law.

B) a tax because the payment is not related to any specific benefit received from the government agency collecting the ticket.

C) not a tax because it is considered a fine intended to punish illegal behavior.

D) a tax because it is imposed by a government agency.

E) not a tax because Margaret could have avoided payment if she did not speed.

Correct Answer:

Verified

Q21: While sales taxes are quite common, currently

Q22: Horizontal equity is defined in terms of

Q23: A use tax is typically imposed by

Q24: Taxes influence which of the following decisions?

A)

Q25: Estimated tax payments are one way the

Q27: Implicit taxes are indirect taxes on tax-favored

Q28: The largest federal tax, in terms of

Q29: The income and substitution effects are two

Q30: Property taxes may be imposed on both

Q31: Excise taxes are typically levied on the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents