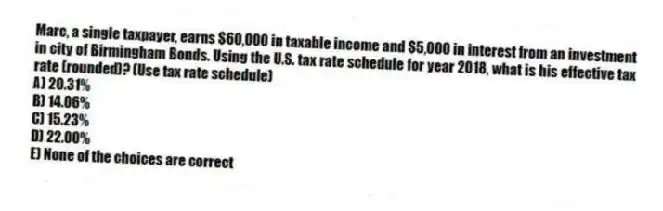

Marc, a single taxpayer, earns $60,000 in taxable income and $5,000 in interest from an investment in city of Birmingham Bonds. Using the U.S. tax rate schedule for year 2018, what is his effective tax rate (rounded) ? (Use tax rate schedule)

A) 20.31%

B) 14.06%

C) 15.23%

D) 22.00%

E) None of the choices are correct

Correct Answer:

Verified

Q43: Which of the following is not one

Q44: Marc, a single taxpayer, earns $60,000 in

Q45: Marc, a single taxpayer, earns $60,000 in

Q46: Which of the following taxes represents the

Q47: Which of the following is considered a

Q49: Which of the following is True?

A) A

Q50: The state of Georgia recently increased its

Q51: The ultimate economic burden of a tax

Q52: Which of the following is False?

A) A

Q53: To calculate a tax, you need to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents