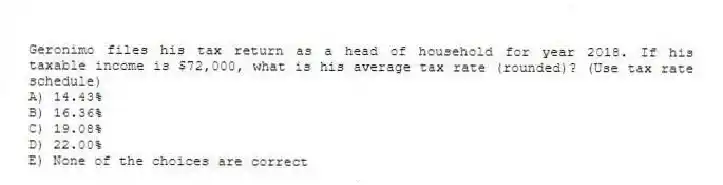

Geronimo files his tax return as a head of household for year 2018. If his taxable income is $72,000, what is his average tax rate (rounded) ? (Use tax rate schedule)

A) 14.43%

B) 16.36%

C) 19.08%

D) 22.00%

E) None of the choices are correct

Correct Answer:

Verified

Q74: Which of the following is True regarding

Q75: Manny, a single taxpayer, earns $65,000 per

Q76: Congress recently approved a new, smaller budget

Q77: Leonardo, who is married but files separately,

Q78: Which of the following is True regarding

Q80: Leonardo, who is married but files separately,

Q81: Jackson has the choice to invest in

Q82: Jonah, a single taxpayer, earns $150,000 in

Q83: Evaluate the U.S. federal tax system on

Q84: For each of the following, determine if

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents