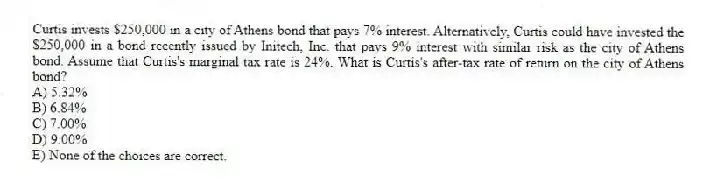

Curtis invests $250,000 in a city of Athens bond that pays 7% interest. Alternatively, Curtis could have invested the $250,000 in a bond recently issued by Initech, Inc. that pays 9% interest with similar risk as the city of Athens bond. Assume that Curtis's marginal tax rate is 24%. What is Curtis's after-tax rate of return on the city of Athens bond?

A) 5.32%

B) 6.84%

C) 7.00%

D) 9.00%

E) None of the choices are correct.

Correct Answer:

Verified

Q95: Curtis invests $250,000 in a city of

Q96: Milton and Rocco are having a heated

Q97: Eliminating the current system of withholding income

Q98: Ricky and Lucy are debating several types

Q99: Although the primary purpose of a tax

Q101: Junior earns $80,000 taxable income as a

Q102: Namratha has the choice between investing in

Q103: Nelson has the choice between investing in

Q104: Fred and Wilma, married taxpayers, earn $100,000

Q105: Consider the following tax rate structure. Is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents