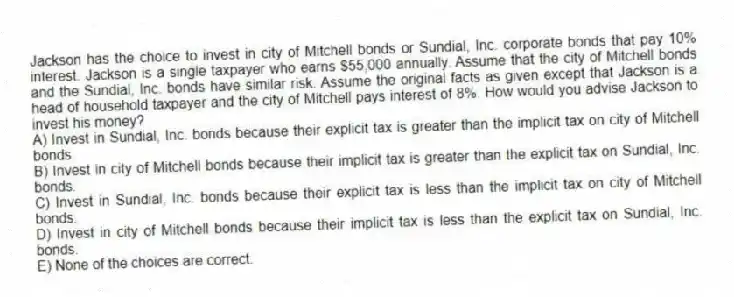

Jackson has the choice to invest in city of Mitchell bonds or Sundial, Inc. corporate bonds that pay 10% interest. Jackson is a single taxpayer who earns $55,000 annually. Assume that the city of Mitchell bonds and the Sundial, Inc. bonds have similar risk. Assume the original facts as given except that Jackson is a head of household taxpayer and the city of Mitchell pays interest of 8%. How would you advise Jackson to invest his money?

A) Invest in Sundial, Inc. bonds because their explicit tax is greater than the implicit tax on city of Mitchell bonds.

B) Invest in city of Mitchell bonds because their implicit tax is greater than the explicit tax on Sundial, Inc. bonds.

C) Invest in Sundial, Inc. bonds because their explicit tax is less than the implicit tax on city of Mitchell bonds.

D) Invest in city of Mitchell bonds because their implicit tax is less than the explicit tax on Sundial, Inc. bonds.

E) None of the choices are correct.

Correct Answer:

Verified

Q86: Bart is contemplating starting his own business.

Q87: Curtis invests $250,000 in a city of

Q88: If Susie earns $750,000 in taxable income

Q89: Oswald is beginning his first tax course

Q90: Raquel recently overheard two journalism students discussing

Q92: Heather, a single taxpayer who files as

Q93: There are several different types of tax

Q94: Curtis invests $250,000 in a city of

Q95: Curtis invests $250,000 in a city of

Q96: Milton and Rocco are having a heated

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents