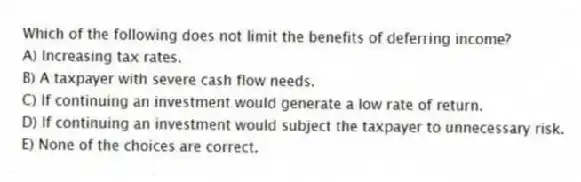

Which of the following does not limit the benefits of deferring income?

A) Increasing tax rates.

B) A taxpayer with severe cash flow needs.

C) If continuing an investment would generate a low rate of return.

D) If continuing an investment would subject the taxpayer to unnecessary risk.

E) None of the choices are correct.

Correct Answer:

Verified

Q36: The downside of tax avoidance includes the

Q37: If tax rates will be lower next

Q38: Which is not a basic tax planning

Q39: Paying dividends to shareholders is one effective

Q40: The assignment of income doctrine is a

Q42: Assuming a positive interest rate, the present

Q43: If Nicolai earns an 8% after-tax rate

Q44: If tax rates are decreasing:

A) taxpayers should

Q45: If Lucy earns a 6% after-tax rate

Q46: If Julius has a 30% tax rate

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents