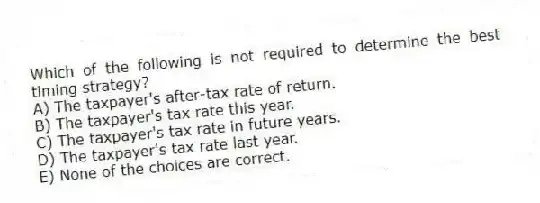

Which of the following is not required to determine the best timing strategy?

A) The taxpayer's after-tax rate of return.

B) The taxpayer's tax rate this year.

C) The taxpayer's tax rate in future years.

D) The taxpayer's tax rate last year.

E) None of the choices are correct.

Correct Answer:

Verified

Q45: If Lucy earns a 6% after-tax rate

Q46: If Julius has a 30% tax rate

Q47: If Joel earns a 10% after-tax rate

Q48: If Julius has a 20% tax rate

Q49: If tax rates are decreasing:

A) taxpayers should

Q51: Which of the following increases the benefits

Q52: The constructive receipt doctrine:

A) is particularly restrictive

Q53: Which of the following decreases the benefits

Q54: If tax rates are increasing:

A) taxpayers should

Q55: Which of the following tax planning strategies

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents